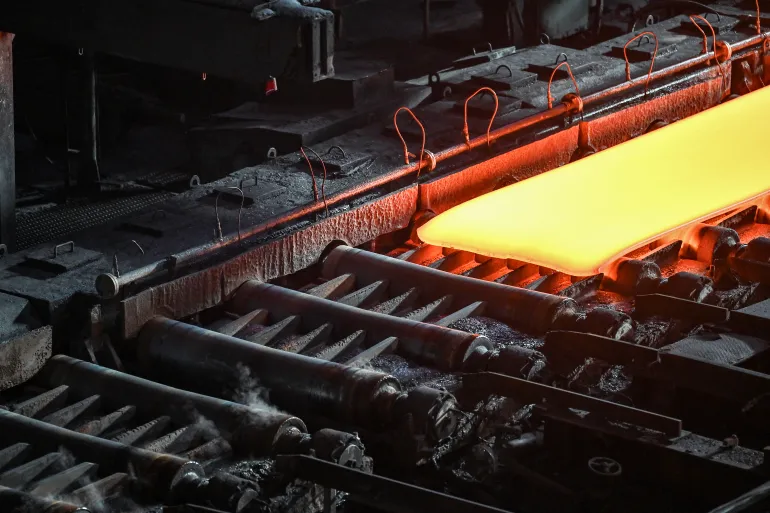

The United States’ trade policies under President Donald Trump are once again making headlines as he vows to implement tariffs on steel and aluminum with “no exemptions, no exceptions.” This decision has triggered a flurry of diplomatic efforts from some of the US’s closest allies, including Japan, South Korea, and Australia, as they seek exemptions from the hefty 25% tariffs imposed on steel and aluminum imports. The stakes are high, with billions of dollars in trade and international relations hanging in the balance.

Japan and Australia, both US treaty allies with export-driven economies, have publicly confirmed their intentions to lobby the US government for exemptions. South Korea has also entered the fray, seeking high-level discussions with Washington to mitigate the potential economic fallout.

Japanese Prime Minister Shigeru Ishiba, who recently met with Trump in Washington, assured the Japanese parliament that his government is actively working on securing an exemption. “We will take necessary measures, including lobbying the United States for an exemption, while closely monitoring any possible impact on the Japanese economy,” Ishiba stated.

As Japan and South Korea hold large trade surpluses with the US—$68 billion and $66 billion respectively in 2024—their strategies may include increasing US imports to balance trade deficits.

Shigeto Nagai, Asia head of Oxford Economics, pointed out that Japan’s technological superiority in key industries, such as semiconductor equipment and materials, could be leveraged as a bargaining chip. “Japan enjoys a large trade surplus with the US for machineries, which incentivizes the US to impose tariffs. However, the US still depends on Japanese machinery for maintaining a technological edge in strategic industries,” Nagai explained.

During his meeting with Prime Minister Ishiba at the White House, Trump acknowledged the importance of strengthening domestic industry and energy security. Australia, a key US ally, is also pushing for an exemption, citing the long-standing trade relationship between the two nations. Trump initially left the door open for Australia, remarking that he would give “great consideration” to an exemption, but this optimism was quickly dampened by Peter Navarro, Trump’s senior trade adviser.

Navarro argued that Australia was “killing” the US aluminum market, citing fluctuating export figures. Australia’s aluminum exports surged after Trump’s first term, peaking at 269,000 tonnes in 2019 before falling to 83,000 tonnes in 2024.

Craig Mark, an economics lecturer at Hosei University in Tokyo, emphasized the volatility of Trump’s trade policies. “The second Trump administration is acting both more ruthlessly and chaotically than the first. US allies such as Japan, Australia, and NATO/EU partners will continue to face a highly unpredictable diplomatic landscape,” Mark noted.

This is not the first time Japan, South Korea, and Australia have found themselves in this predicament. Trump’s first term saw a mixed approach to trade exemptions, with Australia receiving a reprieve on steel and aluminum tariffs while Japan was left out. Meanwhile, South Korea was granted a duty-free steel quota of 2.63 million tonnes.

Under former President Joe Biden, tariffs on Japanese steel were eased in 2022, allowing 1.25 million metric tonnes of duty-free steel imports annually while maintaining aluminum tariffs. With Trump back in office, the prospect of renewed tariffs and unpredictable negotiations looms large over international trade relations.

The uncertainty surrounding Trump’s trade policies has made it difficult for allies to strategize. Deborah Elms, head of trade policy at the Hinrich Foundation in Singapore, noted the inconsistencies in Trump’s trade direction. “Trump himself may not be certain of his long-term policy goals. Even if he articulates a position today, that stance may shift within hours, days, or weeks,” Elms said.

With the world watching closely, the next few weeks will be crucial as US allies ramp up their efforts to secure exemptions and mitigate the economic impact of the tariffs. Whether Trump will relent or double down remains an open question.

For in-depth analysis and exclusive updates on global trade policies, technology trends, and business news, sign up for our newsletter at www.innovationtimes.com and stay ahead of the curve!

Stay ahead with the latest news on global innovation, leadership, entrepreneurship, business, and tech. Join us on WhatsApp or Telegram for real-time updates. Have a report or article? Send it to report@theinnovationtimes.com.

Follow us on X (Twitter), Instagram, LinkedIn, Pinterest and Facebook for more insights and trends