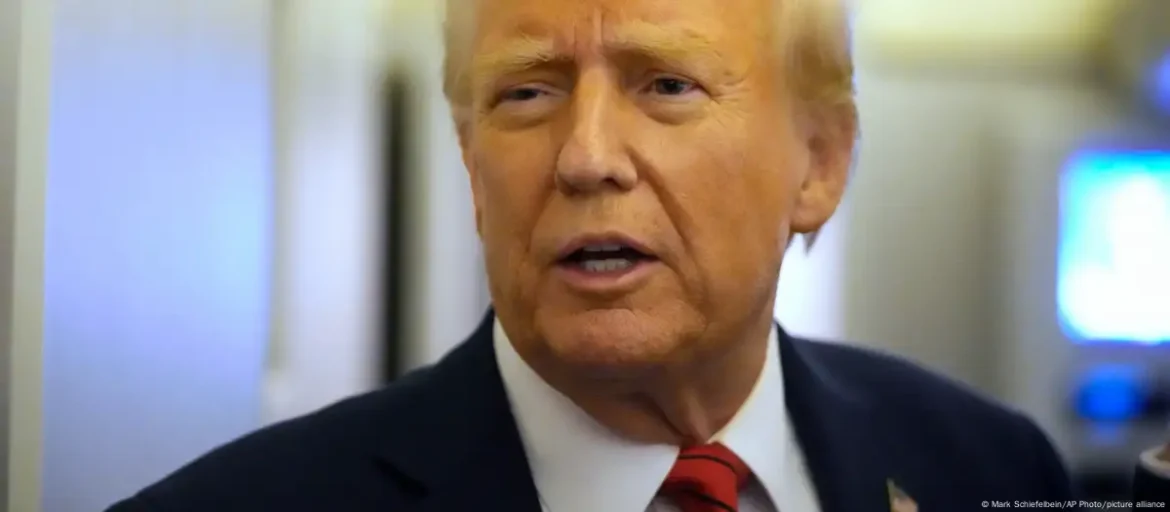

In a daring declaration that could send shockwaves through global trade, US President Donald Trump has issued a stern warning to the BRICS nations, threatening to impose a staggering 100% tariff on any attempts to replace the US dollar as the world’s primary reserve currency. The threat, delivered on Thursday, underscores Trump’s unyielding commitment to preserving the dollar’s dominance in international trade, despite growing talks within the BRICS bloc to create a competing currency.

This latest remark from Trump follows a similar statement made shortly after his victory in the November 2024 elections, signaling his resolve to maintain America’s economic leadership on the world stage. “We are going to require a commitment from these seemingly hostile countries that they will neither create a new BRICS currency, nor back any other currency to replace the mighty US dollar, or they will face 100% Tariffs,” Trump posted on his Truth Social platform. He didn’t mince words in reinforcing the strength of the US dollar: “There is no chance that BRICS will replace the US dollar in international trade, or anywhere else, and any country that tries should say hello to tariffs, and goodbye to America!”

The BRICS group which includes Brazil, Russia, India, China, and South Africa represents nearly half of the global population and has been pushing for reforms in the global financial system. The bloc, formed in 2009 as a counter to Western-dominated global institutions, also includes recent members such as Egypt, United Arab Emirates, Ethiopia, Iran, and Indonesia. This expansion, along with increasing dissatisfaction with US influence, has fueled discussions about creating an alternative to the US dollar for trade.

These discussions gained momentum particularly after Western sanctions were imposed on Russia due to its military actions in Ukraine, highlighting the vulnerability of nations relying on the US-dominated financial system. Amid these tensions, the BRICS group has explored the possibility of introducing a new reserve currency to challenge the dollar’s supremacy.

However, Trump’s latest remarks signal a direct challenge to these efforts. He firmly believes that any attempts by BRICS to replace the dollar would face severe economic consequences. “The power of the US dollar in the world has only strengthened,” Trump emphasized, positioning the US as the cornerstone of the global economy. “We are not about to let these nations undermine it.”

Trump’s stance is not without consequence. A move to replace the US dollar as the global reserve currency would have far-reaching implications, not just for BRICS, but for the entire international financial system. The US dollar is deeply embedded in global trade and finance, with central banks worldwide holding dollar-denominated assets. Any challenge to its dominance could shake the foundation of global markets and trigger a ripple effect that impacts everything from currency valuations to trade agreements.

For BRICS nations, the idea of an alternative currency is appealing, especially as economic power shifts towards the East. However, the US has made it clear that it will use its economic might to prevent such a transition. The specter of 100% tariffs serves as a stark reminder of the consequences that could arise from a shift away from the dollar.

Despite the push for diversification, the US dollar remains the world’s primary reserve currency. It is used in over 80% of global transactions, and US Treasury bonds are a cornerstone of international investment. While the BRICS nations may have the economic weight to challenge this dominance, the entrenched position of the dollar presents a formidable barrier.

Trump’s threats also come at a time when global trade is already undergoing significant shifts. With the rise of emerging markets and increasing efforts by countries like China to establish alternative financial networks, the dollar’s role is under more scrutiny than ever before. However, even with these challenges, the US dollar remains resilient, bolstered by the size and influence of the US economy.

Trump’s remarks reflect a broader strategy to reinforce the US’s economic supremacy, a theme that has been central to his policies since taking office. His administration’s aggressive stance on tariffs and trade deals has been framed as an effort to put America first, with the goal of ensuring that the country remains the undisputed leader in global economics.

In addition to targeting BRICS, Trump has set his sights on North America, announcing a 25% tariff on imports from both Canada and Mexico, effective Saturday. This decision comes as part of his broader trade agenda, which seeks to address what he perceives as unfair trade practices and imbalances with these key neighbors.

However, Trump’s stance on oil imports from Canada and Mexico remains uncertain. He hinted that the imposition of tariffs on oil could depend on whether the prices charged by these countries are deemed fair by the US government. Oil prices are a key point of contention, especially as Trump seeks to balance economic pressures with his broader foreign policy objectives.

Trump’s trade policies also tie into his ongoing efforts to curb illegal immigration and the smuggling of harmful substances like fentanyl into the US. The opioid crisis remains a critical issue for the administration, and Trump has emphasized the need for tighter controls on imports from both Canada and Mexico as part of a broader strategy to protect American lives and national security.

Trump’s aggressive trade policies, particularly his threat of 100% tariffs on BRICS nations and Canada and Mexico, have the potential to reshape global trade dynamics. While such threats may be intended as leverage in ongoing negotiations, they also risk further escalating tensions with key global partners. The implications of these actions could have profound effects on international trade, investment, and the global balance of power.

The US has long been a dominant force in global economics, but as geopolitical power shifts and emerging economies gain influence, the future of the dollar and global trade is increasingly uncertain. Trump’s hardline approach to protecting American interests reflects this ongoing power struggle, but whether such tactics will lead to lasting results remains to be seen.

Stay ahead with the latest news on global innovation, leadership, entrepreneurship, business, and tech. Join us on WhatsApp or Telegram for real-time updates. Have a report or article? Send it to report@theinnovationtimes.com.

Follow us on X (Twitter), Instagram, LinkedIn, Pinterest, and Facebook for more insights and trends.